Finance Secretary Ralph Recto revealed at an informal press conference that authorities are looking into enacting stricter rules and raising taxes as part of a broader effort to further regulate online gambling in the country.

“There are many ways to do it. One is to give it to PAGCOR,” Recto said, referring to the Philippine Amusement and Gaming Corp. ( PAGCOR ). “Because PAGCOR itself can raise the fees it collects from online gaming.”

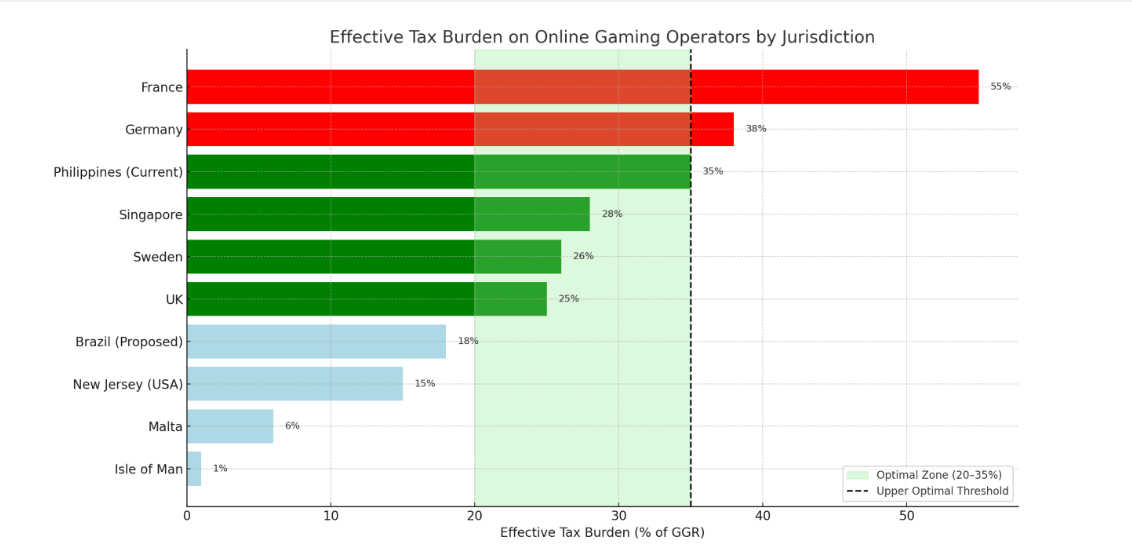

Currently, the Philippine Amusement and Gaming Corporation (PAGCOR) charges a 30% fee on electronic gaming, while the Bureau of Internal Revenue imposes an additional 5% franchise tax, bringing the total tax burden on operators to about 38% of gross gaming revenue (GGR). Recto said a 10% increase could bring the government an additional PHP20 billion (USD341 million) in revenue annually.

Recto also made other regulatory recommendations, including mandatory warnings about gambling addiction, restrictions on minors through national identity verification, and possible requirements for online gaming operators to be publicly listed to increase transparency.

However, the proposed measures have been strongly opposed by industry experts, who argue that any additional taxes would be excessive and could have unintended consequences.

Tonet Quiogue, a renowned gaming law expert and CEO of Arden Consult, released a comprehensive policy brief on July 13 refuting the proposed tax increase. Her analysis warned that further tax increases could cause operators to enter the grey or illegal market.

“The reality is that licensed online gaming companies already pay some of the highest taxes in the world,” Quigley wrote. She explained that the actual license fees PAGCOR collects will average 30% of gross gaming revenue by 2025, down from an all-time high of 47.5%. PAGCOR is also subject to a 10% audit fee (equivalent to 3% of gross gaming revenue) and a 5% franchise tax levied by the national government.

“Overall, approximately 35 to 38 percent of each operator’s gross gaming revenue is collected by the government before any operating costs or profits are calculated,” Quiogue said.

She further stressed that licensed operators are taxed based on gross revenue rather than net income, which puts them at a disadvantage compared to traditional businesses. “Even if a licensed operator incurs losses or minimal profits in a given period, it must pay PAGCOR’s license fee, franchise tax on gross gaming revenue, and applicable audit fees,” she pointed out.

2025-07-21

2025-07-21