Offshore operators flood YouTube and Reddit

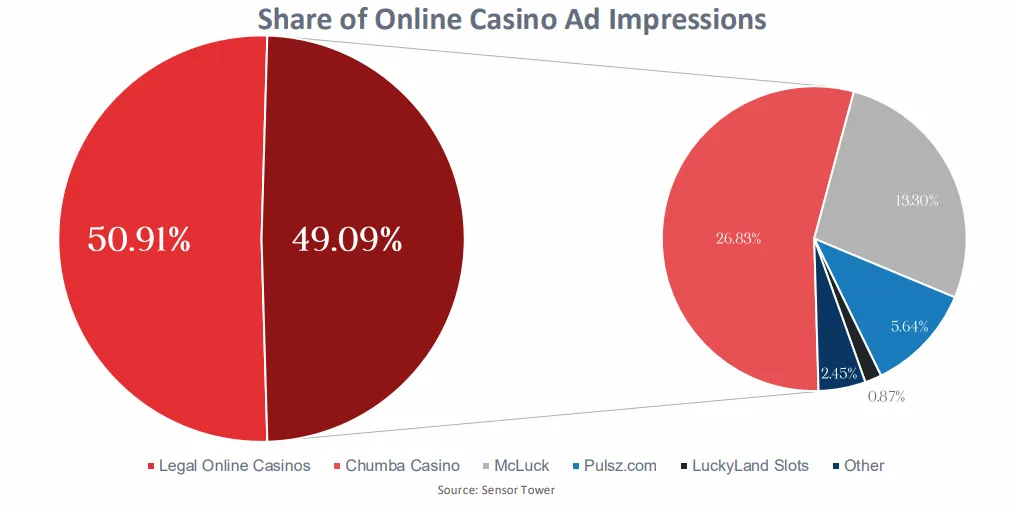

According to data compiled between January and May 2025, “half of all

the online ads for online casinos that consumers are exposed to are for offshore or sweepstakes casinos“. These types of operators are not licensed in the United States, yet their presence in the digital advertising space rivals, and in some cases surpasses, legal providers.

According to the report, legal online casinos make up 50.91% of ad impressions, while the remaining 49.09% are split between offshore brands or sweepstakes such as Chumba Casino, McLuck, and Pulsz.com.

These unlicensed operators are not just prominent; they are strategic. The AGA report notes that “offshore and sweepstakes sites heavily concentrate their ads on specific channels like YouTube or Reddit, while legal operators are more balanced across platforms”.

The collected data clearly shows YouTube accounting for the lion’s share of sweeps casino ad spending, around 65%, with Reddit, Facebook, and TikTok trailing far behind. A strategy that appears to be paying off, as YouTube leads with nearly 1.4 billion impressions, followed by Reddit and Facebook.

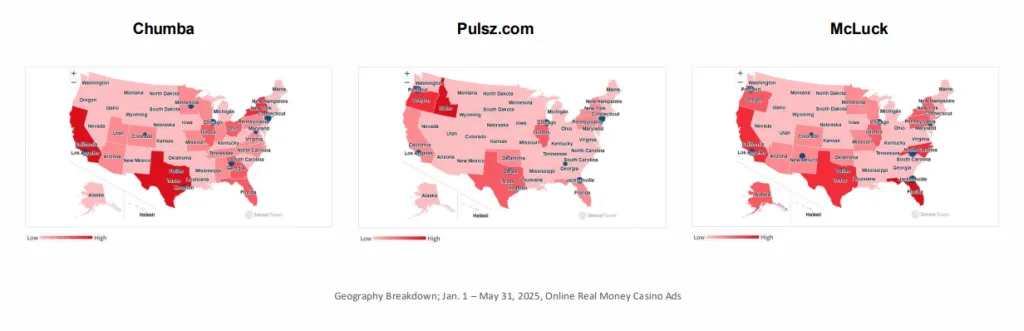

The targeting appears calculated. The report states, “offshore and sweepstakes casinos target consumers in states without sweepstakes enforcement or prohibition actions”. Platforms such as Chumba, Pulsz, and McLuck all focus their advertising on states lacking enforcement.

Legal operators stick to regulated states and diversify spend

By contrast, legal online casinos such as FanDuel, DraftKings, and BetMGM take a different approach. They spread their ad spending across a range of platforms and concentrate efforts in states where online gambling is licensed and regulated.

According to the AGA, legal operators are directing most of their ad spend to over-the-top (media services delivered directly to viewers via the internet, bypassing traditional cable or satellite providers) streaming platforms (just under 30%), followed by Facebook (around 17%) and YouTube (roughly 14%).

Facebook leads in impressions for legal operators, with over 1.4 billion impressions, followed by Instagram, X (formerly Twitter), and YouTube. This indicates a broader and more evenly distributed media strategy.

The AGA notes, “legal online casinos are more balanced” in their advertising approach, with FanDuel, BetMGM, and DraftKings each allocating budget across at least seven different platforms. Notably, none of them rely heavily on Reddit or YouTube alone.

Geographic targeting is also more restrained. According to the report maps, “legal iGaming operators overwhelmingly advertise in legal iGaming states.” FanDuel, DraftKings, and BetMGM focus their efforts almost exclusively in states with clear regulatory frameworks.

A growing concern for regulators

The growing presence of offshore and sweepstakes casinos in the U.S. advertising space raises regulatory concerns. These operators often bypass licensing by exploiting legal grey areas, particularly around sweepstakes-based gambling models.

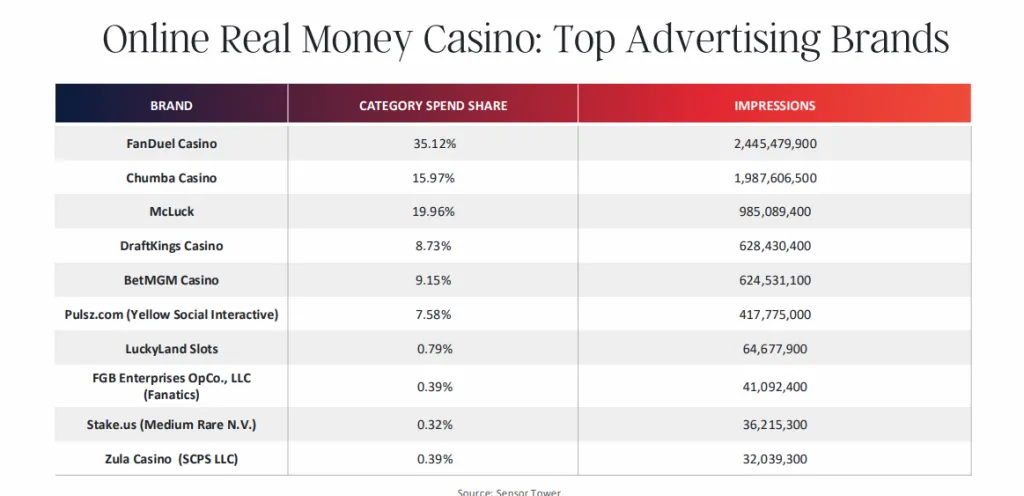

With McLuck and Chumba Casino accounting for approximately 20% and 16% of advertising spend, respectively, legal operators are competing on an uneven playing field.

One particularly revealing chart shows how dominant YouTube is for Pulsz and McLuck. Each devotes over 90% of their ad spend to the platform, signalling an intentional strategy to saturate consumer attention where regulation is lightest.

As the digital landscape evolves, the AGA’s data provides a stark view of an industry split between those who play by the rules and those who don’t.

AGA calls for stronger rules as sweepstakes blur gambling lines

“Sweepstakes casinos exploit legal loopholes to operate outside regulatory oversight without consumer protections, responsible gaming standards, or accountability,” the AGA warned. Despite being marketed as alternatives to online gambling, 59% of respondents said playing on these platforms was “definitely gambling,” while another 31% said it was “probably gambling.”

An AGA survey found that 65% of sweepstakes users said they play to “win real money or rewards,” nearly matching the 67% of iGaming players who said the same. Spending patterns further blur the distinction: 80% of sweepstakes players said they spend money monthly, compared to 50% of users of free-to-play social casino apps.

“Despite operating outside the regulated marketplace, sweepstakes casinos present themselves in ways that mirror legal gaming operators,” the AGA concluded. The group is now calling for “clear legal definitions to distinguish sweepstakes casinos from regulated gaming,” along with stronger enforcement and consumer education initiatives.

2025-08-15

2025-08-15